There is no doubt that the stock market provides tons of option in investment for the investors. This is one of the investment platforms where everyone can enter without minding the academic qualification and financial status to make unlimited income. But at the same time of providing excellent earning potentials, the stock market is also prone to several risks of losses. Stock exchanges demand the investors keep some amount in the account to meet these losses and it called as SPAN margin.

Maintain the trading account

You need both demat account and trading account to enter the stock market. Trading account is maintained to keep the cash transactions. The sufficient amount to this account can be transferred from your personal account. The amount in this account is used to purchase the stock and the amount will be transferred to this account on sales of the commodities. Since the stock market is subjected to changes in accordance with the market conditions, unexpected incidents, financial crisis and due to more factors, NSE demand the investors to keep sufficient amount as NSE Margin.

Be free from the penalty

You have to keep the margin amount in accordance with the volume or value of the stock or commodities in the demat account where they are stored in the electronic format. The stock exchange can charge the penalty for the insufficient amount in the account. Hence you should take care of keeping the sufficient amount enough to compensate the losses in necessary circumstances to be free from penalty.

Calculate the margin

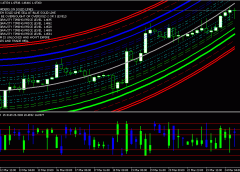

Do you know the exact margin amount to maintain in the account? The answer will be ‘no’ and you have to make the necessary calculation to get the amount. Here comes the importance of the technique called SPAN (Standardized Portfolio Analysis of Risk). This is the technique used by the exchanges to calculate the margin amount of the investors in accordance with the value of the stock. Now reputed stockbrokers have developed margin calculators using this technique to make the calculation really easy and to help the investors in keeping sufficient amount in the account.

Better use of margin amount

The margin amount of particular stock is calculated by taking the worst condition of the market can experience in accordance with the historic volatility of the product. Most of the investors always keep a good amount in the trading account to purchase the stocks and commodities at the right times. Better knowledge about the margin amount helps the investors to make use of the rest of the amount in the account in a better way to invest in other portfolios.

Now you better know the importance of keeping NSE Margin in your trading account. Make sure that your stock provider provides free margin calculator to keep sufficient margin amount in the account and make effective use of rest of the amount. Now almost all of the investors calculate the margin amount of the commodities in advance to minimize the risk of losses and to enjoy successful trades with minimum investment.